H And R Block Depreciation For A New Roof

From there the depreciation and specialist tax team will review the information gathered and prepare your tax depreciation schedule.

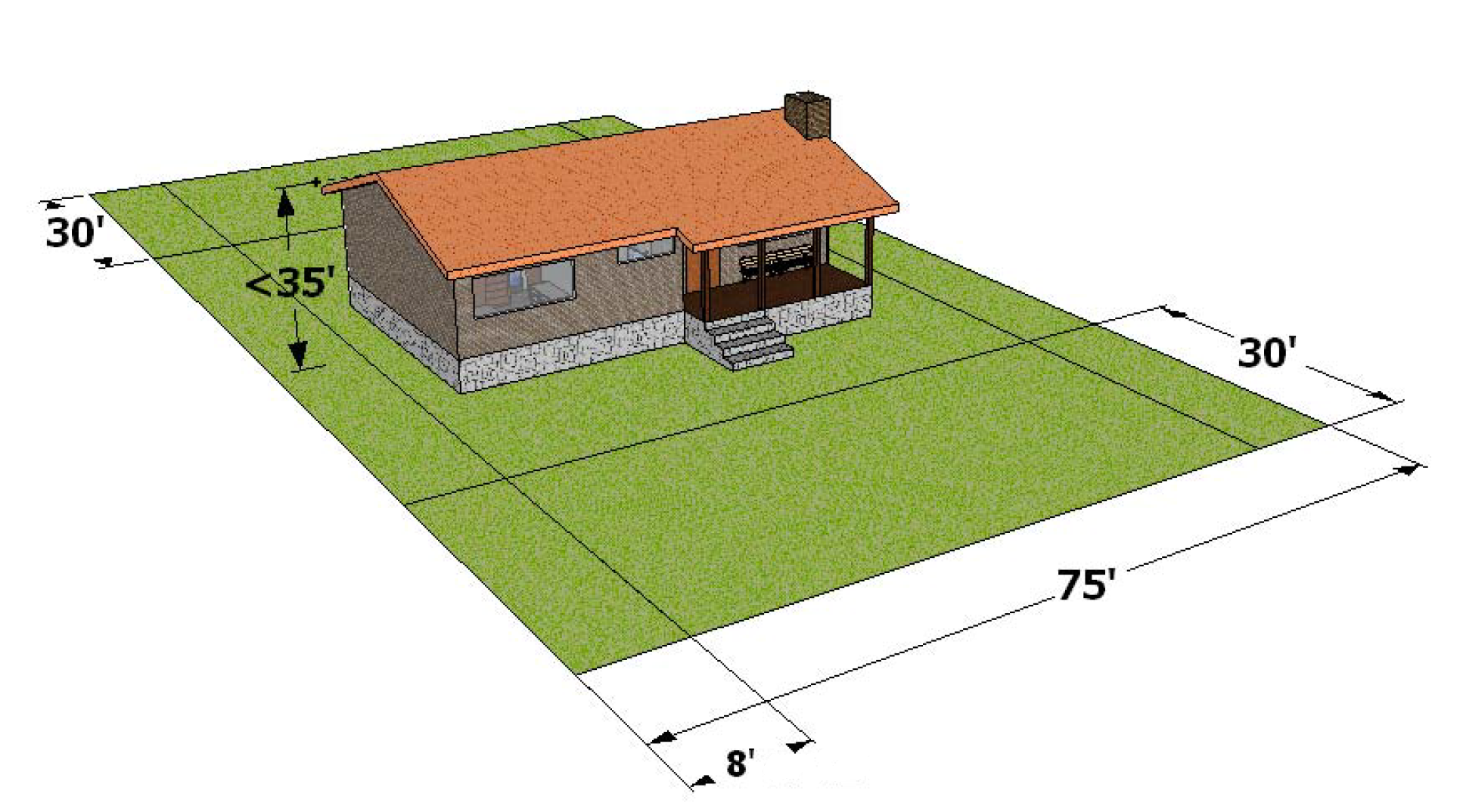

H and r block depreciation for a new roof. H r block has been approved by the california tax. Depreciation ends after 27 5 years when you have fully recovered the cost of the new roof. If the property is tenanted you bring the roof into service on the day you install it. Calculating depreciation based on age is straightforward.

The roof depreciates in value 5 for every year or 25 in this case. A new client is defined as an individual who did not use h r block or block advisors office services to prepare his or her prior year tax return. Installing a new roof is considered a home improve and home improvement costs are not deductible. How is depreciation on a roof calculated.

I own a condo that i rent out. Depreciation starts when you bring the new roof into service. The roof structure usually includes some type of deck spanning a network of load bearing structural joists and beams. The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

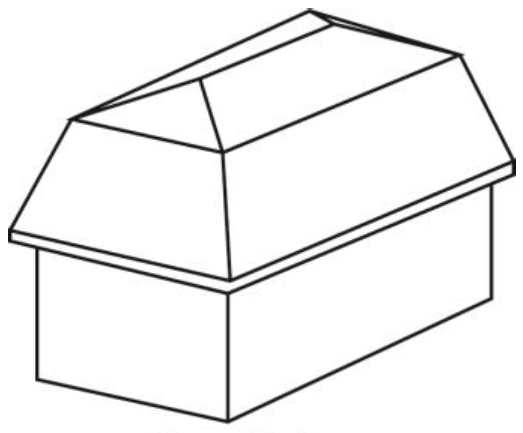

A roof system includes a roof structure and multiple layers of materials above it. We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors. For most homeowners the basis for your home is the price you paid for the home for or the cost to build your home. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged. The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time. Bmt can even forward your schedule to your h r block accountant directly saving you time. A roof system is a major component because it performs a discrete and critical function in a building structure.

Depreciating a new roof a new roof is considered a capital improvement and therefore subject to its own depreciation. If the property is unoccupied you bring the roof into service when you next lease the rental property. For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property. I input this information into turbotax and it ask me if i d like to use a special depreciation allowance and deduct the entire expense this year.

At the end of last year the roof for the entire building was replaced. However home improvement costs can increase the basis of your property. When a claims adjuster looks at a roof he will consider the condition of the roof as.